The IRS as Morality Police: How Trump's Tip Tax Policy Threatens Constitutional Freedoms

Published

- 3 min read

The Proposed Policy and Its Implications

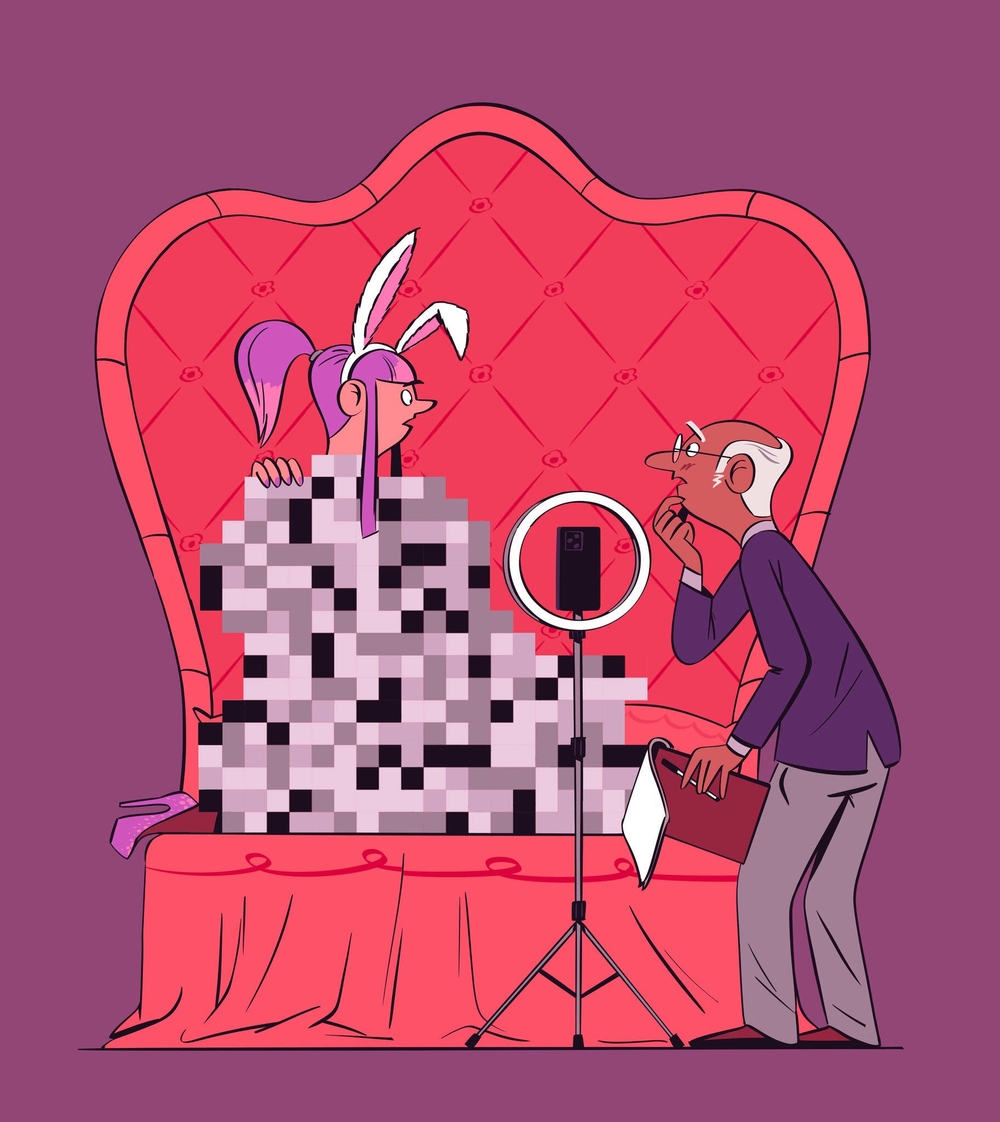

The Trump administration’s recent proposal to create a tax deduction for tipped workers has revealed a disturbing willingness to weaponize the tax code against disfavored professions. While the policy ostensibly aims to provide relief for service workers, it contains a glaring exception: earnings from “pornographic activity” would be explicitly excluded from this tax benefit. This exclusion raises profound questions about the proper role of government, the limits of state power, and the protection of individual liberties guaranteed by our Constitution.

The policy emerges from sweeping tax cuts passed by Republicans this summer, which created a new deduction for tips—not a complete exemption from taxes, but still a significant incentive. To prevent widespread reclassification of income as tips, the IRS and Treasury Department had to establish boundaries, limiting the deduction to occupations that “customarily and regularly” receive tips. The resulting list of nearly 70 eligible occupations included “digital content creators,” “entertainers and performers,” and “dancers”—categories that initially appeared inclusive but were quickly undermined by the pornography exclusion.

The Practical Enforcement Nightmare

The enforcement challenges inherent in this policy are staggering. Tax professionals immediately raised concerns about how the IRS would determine what constitutes “pornographic activity.” As accountant Katherine Studley asked, “Where’s the line? Just because you’re on OnlyFans, that doesn’t necessarily mean it’s pornographic. You could have a cooking channel or a yoga channel.” This question echoes Justice Potter Stewart’s famous 1964 admission about pornography: “I know it when I see it.” Should IRS agents really be making these subjective determinations while auditing taxpayers?

Thomas Gorczynski, a tax preparer and educator, highlighted the inherent subjectivity: “Ultimately, it would be the subjective determination of an IRS examiner or a Tax Court judge. Sometimes you look at something and it’s clearly pornography, but sometimes you look at something and you think, ‘Eh it’s subjective. Somebody might be really into it.‘” This creates a system where government employees become arbiters of morality, a role fundamentally incompatible with a free society.

The Hypocrisy and Discrimination

The origins of this exclusion reveal the troubling influence of social conservative groups on policy-making. Several organizations wrote to Treasury Secretary Scott Bessent arguing that “our government should not give tax breaks to predatory industries that profit from exploiting young men and women, destroying marriages, families, and lives.” John Shelton of Advancing American Freedom—founded by former Vice President Mike Pence—acknowledged that pornography is “sort of an embarrassing thing to bring up” but considered it part of an important cause.

This moralizing approach ignores the staggering hypocrisy involved. The same administration pushing this exclusion is led by a president who was found guilty of falsifying business records to cover a payment to porn actress Stormy Daniels. More fundamentally, it represents a dangerous expansion of government power into areas traditionally reserved for individual conscience and choice.

Constitutional Principles Under Threat

The First Amendment protections for freedom of expression represent a cornerstone of American liberty. While the Supreme Court has acknowledged that obscenity falls outside constitutional protection, the definition remains notoriously difficult to pin down. By creating financial penalties for content deemed “pornographic,” the government effectively chills protected speech and creates a de facto censorship regime through the tax code.

This policy also violates principles of equal protection under the law. Adult content creation is a legal profession in the United States, with platforms like OnlyFans hosting millions of creator accounts and hundreds of millions of fan accounts. These workers pay taxes, contribute to the economy, and deserve the same fundamental rights as any other American worker. Singling them out for discriminatory treatment based on moral objections sets a dangerous precedent that could eventually target other disfavored groups or professions.

The Broader Implications for Economic Freedom

The practical implementation of this policy would create a bureaucratic nightmare. IRS agents would need to review content, make subjective determinations about its nature, and then deny deductions accordingly. This not only wastes government resources but also invades the privacy of citizens engaging in legal activities. As financial planner Jessica Goedtel noted, “The IRS could be used as a tool” for broader crackdowns on the adult entertainment industry.

This approach mirrors the problematic blueprint outlined in Project 2025, which called for outlawing pornography entirely. While mainstream Republicans may not currently support such extreme measures, the tip tax exclusion represents a stepping stone toward greater government control over personal choices and legal occupations.

The Human Cost of Moral Legislation

Beyond the constitutional concerns, this policy has real human consequences for workers in the adult entertainment industry. These individuals already face significant barriers to financial services and social acceptance. Adding discriminatory tax treatment further marginalizes them and denies economic opportunities available to other workers.

Macy Hilt, a 24-year-old content creator who earns approximately $2 million annually, highlighted the absurdity of the policy, noting that she’s “made a lot of money, and a lot of tips, based off just a foot picture.” Her case illustrates the fundamental problem with government attempts to categorize and regulate expression: the lines are inherently blurry, and the definitions necessarily subjective.

A Slippery Slope Toward Expanded Government Control

The tip tax exclusion represents more than just a poorly conceived policy—it signals a dangerous willingness to use government power to enforce moral judgments. Today it’s adult content creators; tomorrow it could be other professions that certain groups find objectionable. Once we accept the principle that the government can discriminate against legal occupations based on moral objections, we open the door to endless invasions of personal liberty.

This approach also contradicts fundamental conservative principles of limited government and individual freedom. True conservatism should respect the ability of adults to make their own choices about consensual activities, without government interference or moral judgment. The tax code should remain neutral regarding the moral character of legal occupations, treating all taxpayers equally regardless of their profession.

The Path Forward: Principles Over Prejudice

A free society must resist the temptation to use government power to enforce particular moral viewpoints. The appropriate response to this problematic policy is clear: remove the exclusion for “pornographic activity” and treat all tipped workers equally under the law. The tax code should focus on raising revenue efficiently and fairly, not on making moral judgments about legal occupations.

Those concerned about the adult entertainment industry should focus on voluntary solutions—education, counseling, and support services—rather than coercive government action. True compassion means respecting individual autonomy while providing resources for those who seek alternatives, not punishing consenting adults for their occupational choices.

Conclusion: Defending Liberty in the Tax Code

The battle over the tip tax deduction may seem like a minor technical matter, but it represents a much larger struggle over the proper role of government in a free society. When we allow the state to discriminate against legal professions based on moral objections, we surrender fundamental principles of equality, privacy, and individual liberty.

The Founders established a system of limited government precisely to prevent majorities from imposing their moral views on minorities through state power. The Trump administration’s proposed exclusion violates this foundational principle and sets a dangerous precedent for future government overreach. As defenders of constitutional government and individual freedom, we must oppose this policy and reaffirm our commitment to a government that treats all citizens equally, regardless of their occupation or lifestyle choices.

The American experiment in liberty depends on our willingness to protect freedoms we may personally dislike. True commitment to constitutional principles means defending the rights of all Americans—not just those who conform to particular moral standards. In the battle between liberty and moral legislating, we must consistently choose freedom.