California's Fiscal Precipice: A Crisis of Volatility and Governance

Published

- 3 min read

The Unraveling of a Budget Forecast

The story of California’s fiscal year is a stark lesson in how quickly fortunes can change in governance. Governor Gavin Newsom began 2024 with what appeared to be a position of strength, announcing in January that the state unexpectedly found itself with $17 billion more in revenue than previously projected. This windfall translated into a modest projected surplus of $363 million for fiscal year 2025-26, creating an atmosphere of cautious optimism. The governor’s office presented this as evidence of a robust economy and sound fiscal management. However, this optimistic forecast would prove to be tragically short-lived, unraveling over just a few short months due to a cascade of unforeseen events and systemic vulnerabilities.

Within months, that surplus prediction transformed into a staggering $12 billion deficit by May. The reversal was dramatic and swift, driven by a perfect storm of exogenous shocks and structural weaknesses. Devastating January wildfires in Los Angeles forced the state to allocate billions in disaster aid while simultaneously delaying tax filings from affected residents, creating an immediate double-hit to the state’s finances. Simultaneously, the cost of Medi-Cal, California’s essential health insurance program for low-income residents, ballooned to $6 billion beyond initial projections, placing immense strain on the social safety net. These domestic challenges were compounded by federal instability, as President Donald Trump’s erratic tariff policies created stock market volatility that directly impacted California’s revenue stream, which relies heavily on taxing the income and capital gains of high earners.

The Deepening Crisis and Projected Consequences

Far from being an isolated incident, this fiscal reversal appears to be part of a disturbing pattern for the nation’s most populous state. The nonpartisan Legislative Analyst’s Office (LAO) delivered even more alarming news in its recent fiscal outlook, projecting the deficit will worsen to nearly $18 billion next year. Astonishingly, this deficit is projected to occur despite strong tax revenues driven by California’s thriving AI boom. The LAO notes that state spending is expected to grow so rapidly that it would offset, if not eclipse, these revenue gains. If this projection holds, it will mark the fourth consecutive year of Governor Newsom’s tenure where California faces a deficit despite revenue growth—a clear indication of a structural problem rather than a temporary setback.

Perhaps most alarming is the LAO’s long-term projection that California’s structural deficit could reach $35 billion annually by fiscal year 2027-28. The state faces approximately $6 billion in additional spending next year alone, including at least $1.3 billion because the state must now cover increased Medi-Cal benefit costs under President Trump’s budget bill. Compounding these challenges, California stands to lose significant federal funding for housing and homelessness programs, creating a perfect storm where needs are increasing while resources are diminishing. The options for addressing this crisis are rapidly diminishing, as the state has already exhausted many one-time measures to balance its books. The LAO explicitly notes that solving an ongoing structural budget problem of this magnitude requires either finding more sustainable revenue streams, making serious and potentially painful cuts to essential services, or some combination of both.

The Structural Vulnerabilities Beneath the Surface

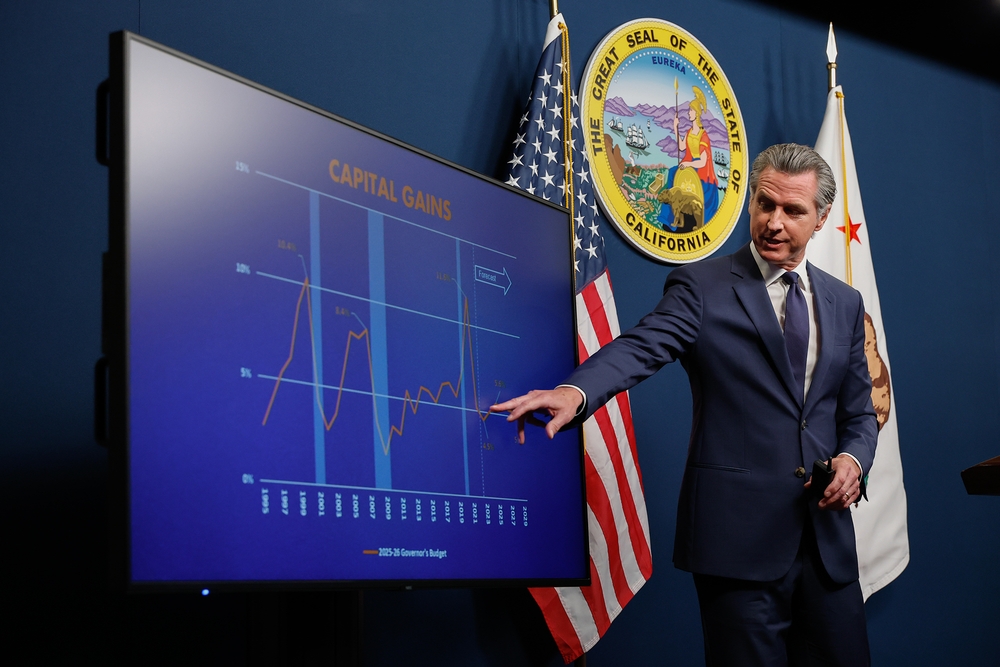

What makes California’s current fiscal predicament particularly concerning is that it represents a recurrence of a known vulnerability rather than an unprecedented crisis. The state’s heavy reliance on taxing high-income earners and capital gains—whose fortunes are inextricably linked to stock market performance—creates inherent volatility in revenue streams. This was dramatically demonstrated in 2022 when the state experienced a nearly $100 billion surplus, only to face a projected $56 billion deficit over the following two years. This boom-and-bust cycle undermines the stability required for effective long-term governance and threatens the consistent delivery of essential services that citizens depend on.

The response to this year’s deficit reveals the difficult choices facing policymakers. Governor Newsom initially proposed drastic cuts to Medi-Cal but ultimately negotiated a budget with state lawmakers that relied heavily on internal borrowing, dipping into the state’s reserves, and freezing Medi-Cal enrollment for undocumented immigrants to avoid deeper cuts to other social services. While these measures may provide temporary relief, they do not address the fundamental structural issues. Democratic leaders have largely blamed the Trump administration for California’s budget problems, pointing to federal policies that have created uncertainty and additional financial burdens. However, this finger-pointing, while perhaps justified in specific instances, does little to solve the underlying problem of a revenue system that lacks stability and predictability.

A Crisis of Democratic Governance and Principle

From the perspective of democratic principles and effective governance, California’s fiscal crisis represents more than just a budget shortfall—it constitutes a fundamental failure to build resilient systems that can withstand external shocks while protecting the most vulnerable citizens. The volatility of California’s revenue structure directly undermines the state’s ability to fulfill its most basic democratic obligations: providing consistent, reliable services and maintaining the social contract with its citizens. When essential programs like healthcare for low-income residents become subject to the whims of stock market fluctuations and federal political battles, we have strayed dangerously far from the principles of stable, predictable governance that form the foundation of a functioning democracy.

What makes this situation particularly galling from a principled standpoint is that it represents a preventable crisis. The structural vulnerabilities in California’s revenue system have been well-documented for years, yet meaningful reforms have consistently been postponed in favor of temporary fixes that kick the can down the road. This approach prioritizes short-term political convenience over long-term fiscal responsibility—a betrayal of the public trust that ultimately harms those who most depend on government services. The fact that we are now facing the prospect of consecutive deficits despite revenue growth indicates a profound failure of foresight and political courage.

The Human Cost of Fiscal Instability

Behind the abstract numbers and budget projections lie real human consequences that should outrage every citizen who values compassion and human dignity. The proposed freeze on Medi-Cal enrollment for undocumented immigrants, while perhaps a fiscal necessity in the short term, represents a moral failure that runs counter to our nation’s foundational values. Similarly, the potential loss of federal housing and homelessness funding threatens to exacerbate an already catastrophic crisis on California’s streets. These are not merely line items in a budget spreadsheet; they represent healthcare, shelter, and basic dignity for our most vulnerable neighbors.

The instability created by this fiscal crisis undermines the rule of law by creating uncertainty about which services will be available and to whom. When citizens cannot rely on consistent support from their government, faith in democratic institutions erodes. This is particularly true for marginalized communities who disproportionately depend on social services. The fact that budget stability has become subject to the volatility of stock markets and the unpredictability of federal policy represents a dangerous subversion of democratic accountability. Governments should be responsive to the needs of their citizens, not the fluctuations of Wall Street or the political whims of Washington.

The Path Forward: Principles Over Politics

Addressing California’s fiscal crisis requires confronting uncomfortable truths and making difficult choices that transcend partisan politics. First and foremost, the state must acknowledge that its current revenue structure is fundamentally unsustainable and take concrete steps toward creating a more stable, diversified tax base. This may involve politically challenging conversations about tax reform that reduces dependence on volatile income streams from high earners. While no single solution will be painless, continuing down the current path guarantees repeated crises that will ultimately cause greater harm.

Second, California must engage in an honest assessment of spending priorities that distinguishes between essential services that protect human dignity and discretionary programs that may need to be scaled back during difficult fiscal periods. This process should be guided by principle rather than political expediency, with a clear commitment to protecting the most vulnerable while ensuring long-term fiscal sustainability. The current approach of relying on one-time fixes and reserve withdrawals merely postpones necessary reckoning while allowing structural problems to worsen.

Finally, California’s leaders must recognize that while federal policies undoubtedly contribute to the state’s challenges, blaming Washington provides little comfort to citizens facing reduced services or higher costs. True leadership requires taking responsibility for solving problems within one’s jurisdiction, even when external factors complicate those efforts. This means building more resilient systems that can withstand federal instability while continuing to advocate for policies that support rather than undermine state efforts.

Conclusion: A Test of Democratic Resilience

California’s budget crisis represents a critical test of whether democratic governance can respond effectively to complex challenges without sacrificing its foundational principles. The solutions will require courage, creativity, and a willingness to prioritize long-term stability over short-term political convenience. Most importantly, they must be guided by an unwavering commitment to human dignity, the rule of law, and the democratic ideals that form the bedrock of our society. The alternative—continued volatility and reactive governance—threatens not just California’s fiscal health but the very credibility of democratic institutions at a time when they face unprecedented challenges. The path forward is difficult, but the stakes could not be higher for both California and the nation it so often leads.